To view previous archived examples, click here: September 2024 - May 2025

To view previous archived examples, click here: May 2024 - August 2024

To view previous archived examples, click here: February 2024 - April 2024

To view previous archived examples, click here: August 2023 - January 2024

To view previous archived examples, click here: April 2023 - July 2023

Dynamic Trend Gamma

Thursday July 17th - $SPX

Dynamic Trend Gamma

Wednesday July 16th - $SPY

Dynamic Trend Gamma

Tuesday July 15th - $SPX

Dynamic Trend Gamma

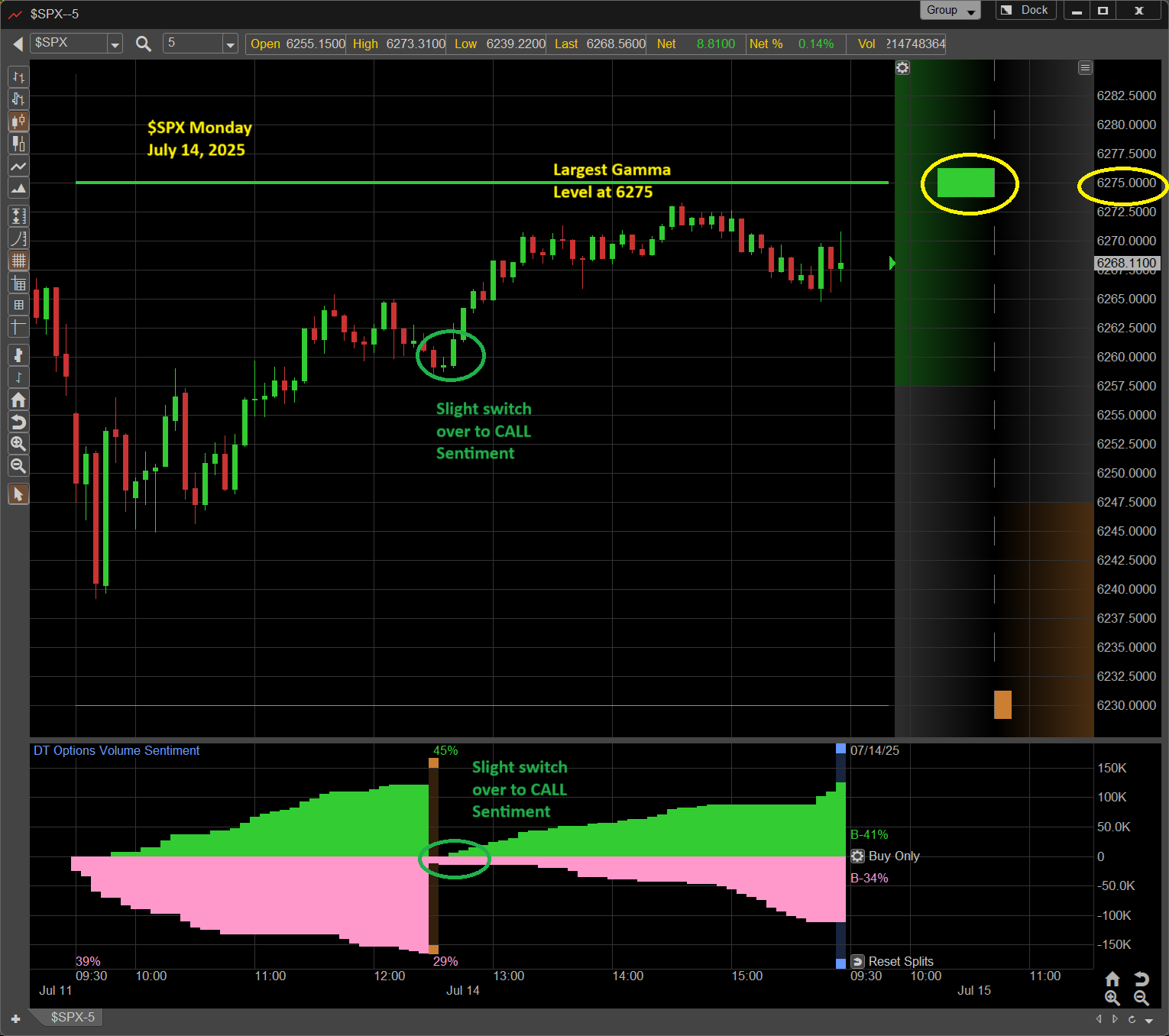

Monday July 14th - $SPX

Dynamic Trend Gamma

Thursday July 10th - $SPX

Dynamic Trend Gamma

Wednesday July 2nd - $SPX

Dynamic Trend Gamma

Monday June 30th - $SPY

Dynamic Trend Gamma

Friday June 27th - $SPX

Dynamic Trend Gamma

Thursday June 26th - $SPX

Dynamic Trend Gamma

Tuesday June 24th - $SPX

Dynamic Trend Gamma

Monday June 23rd - $SPX

Dynamic Trend Gamma

Wednesday June 18th - $SPX

Dynamic Trend Gamma

Tuesday June 17th - $SPX

Dynamic Trend Gamma

Monday June 16th - $SPX

Dynamic Trend Gamma

Friday June 13th - $SPY

Dynamic Trend Gamma

Wednesday June 11th - $SPY

Dynamic Trend Gamma

Thursday June 5th - $SPX

Dynamic Trend Gamma

Tuesday June 3rd - $SPY

Dynamic Trend Gamma

Monday June 2nd - $SPY