Gamma Archive Examples

Dynamic Trend Gamma

Thursday March 5th - $SPY

Dynamic Trend Gamma

Wednesday March 4th - $SPY

Dynamic Trend Gamma

Monday March 2nd - $SPX

Dynamic Trend Gamma

Friday February 27th - $SPX

Dynamic Trend Gamma

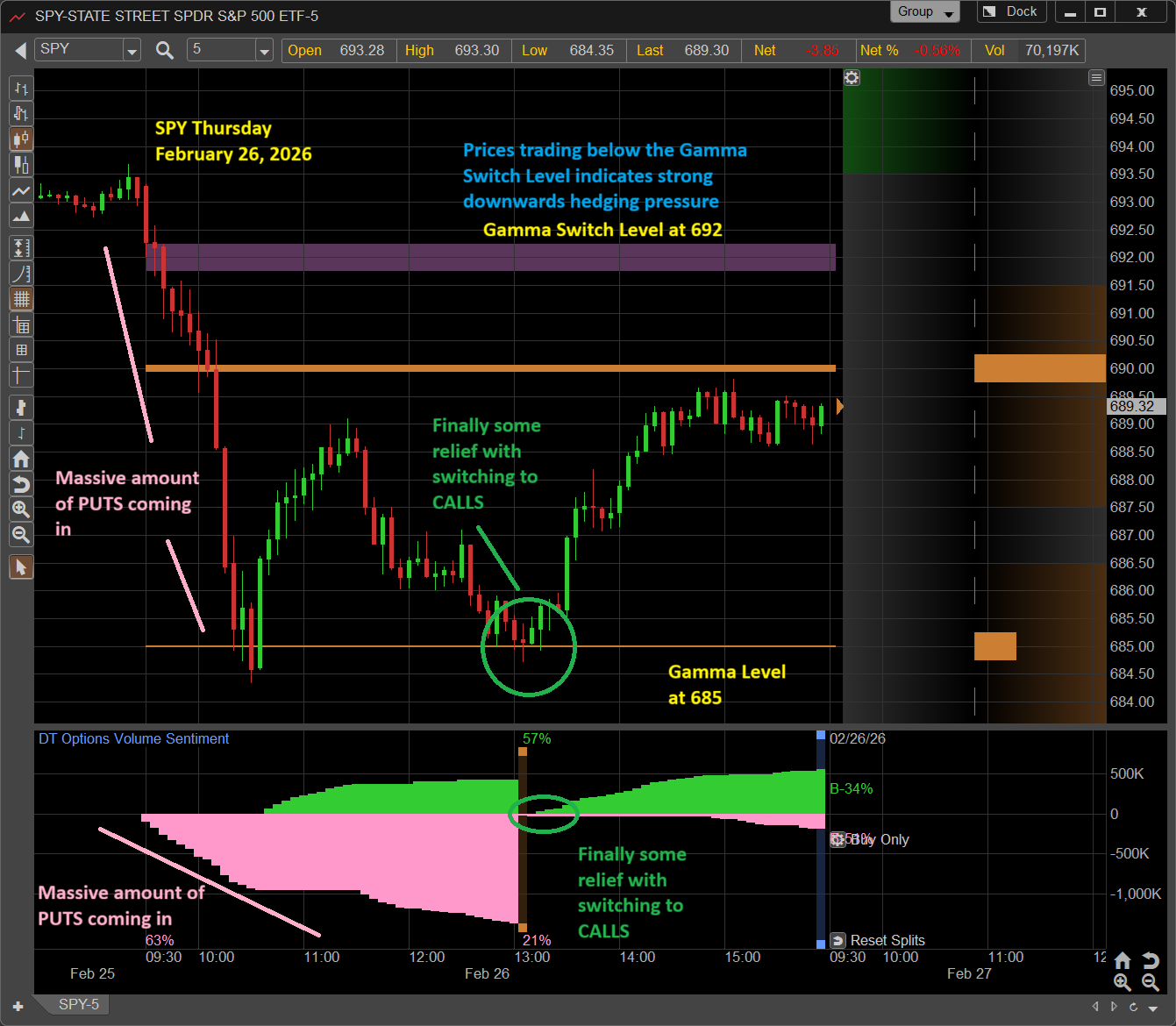

Thursday February 26th - $SPY

Dynamic Trend Gamma

Wednesday February 25th - $SPX

Dynamic Trend Gamma

Tuesday February 24th - $SPX

Dynamic Trend Gamma

Monday February 23rd - $SPY

Dynamic Trend Gamma

Tuesday February 17th - $SPX

Dynamic Trend Gamma

Friday February 13th - $SPX

Dynamic Trend Gamma

Thursday February 12th - $SPY

Dynamic Trend Gamma

Wednesday February 11th - $SPY

Dynamic Trend Gamma

Monday February 9th - $SPX

Dynamic Trend Gamma

Wednesday February 4th - $SPX

Dynamic Trend Gamma

Tuesday February 3rd - $SPX

Dynamic Trend Gamma

Friday January 30th - $SPY

Dynamic Trend Gamma

Thursday January 29th - $SPX

Dynamic Trend Gamma

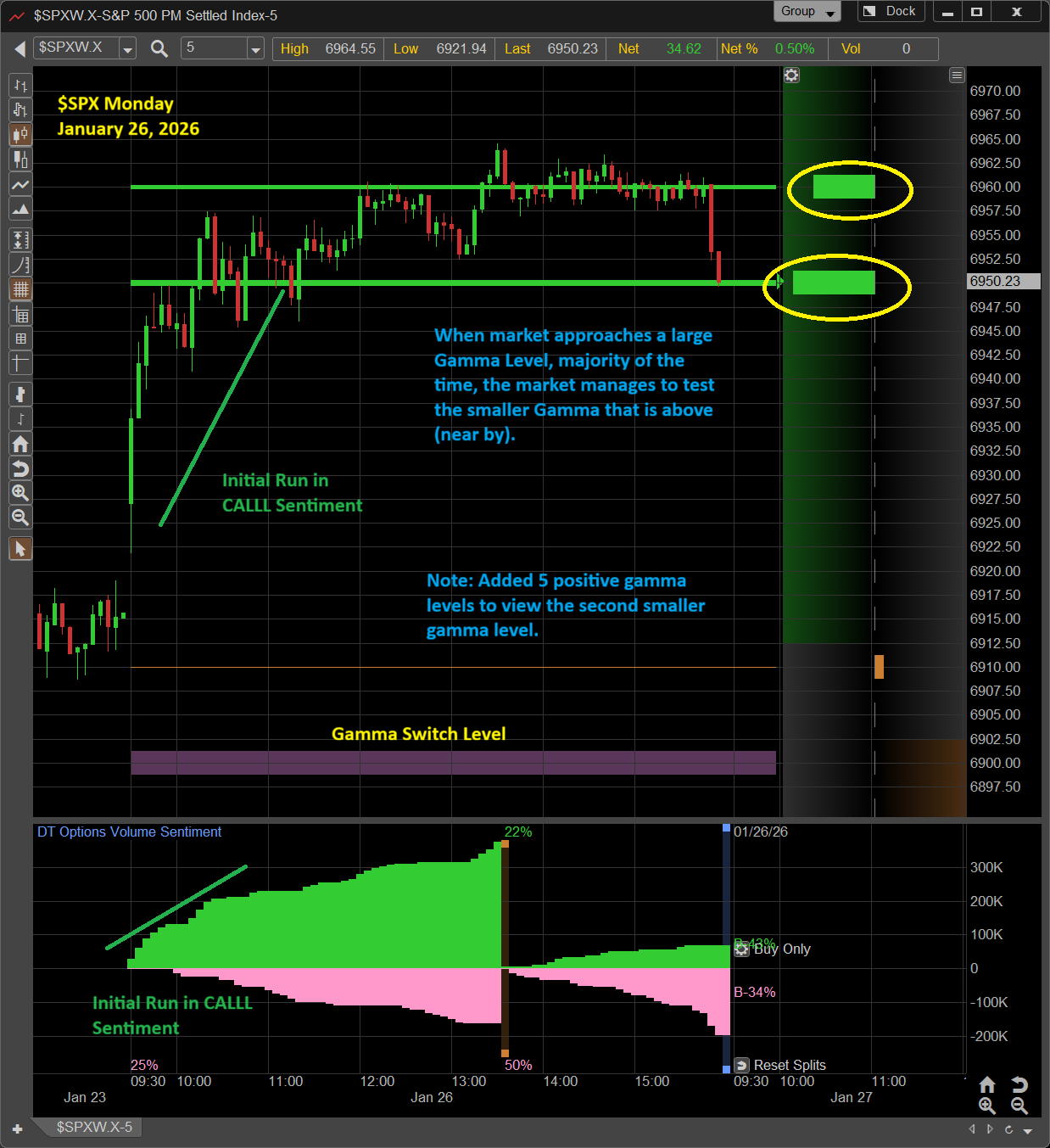

Monday January 26th - $SPX

Dynamic Trend Gamma

Thursday January 22nd - $SPX

Dynamic Trend Gamma

Thursday January 22nd - $SPX

Dynamic Trend Gamma

Wednesday January 21st - $SPX

Dynamic Trend Gamma

Tuesday January 20th - $SPX

Dynamic Trend Gamma

Friday January 16th - $SPY

Dynamic Trend Gamma

Thursday January 15th - $SPX

Dynamic Trend Gamma

Wednesday January 14th - $SPX

Dynamic Trend Gamma

Monday January 12th - $SPX

Dynamic Trend Gamma

Friday January 9th - $SPY

Dynamic Trend Gamma

Wednesday January 7th - $SPX

Dynamic Trend Gamma

Tuesday January 6th - $SPX

Dynamic Trend Gamma

Monday January 5th - $SPY

Dynamic Trend Gamma

Friday January 2nd - $SPY

Dynamic Trend Gamma

Wednesday December 31st - $SPX

Dynamic Trend Gamma

Friday December 26th - $SPX

Dynamic Trend Gamma

Wednesday December 24th - $SPY

Dynamic Trend Gamma

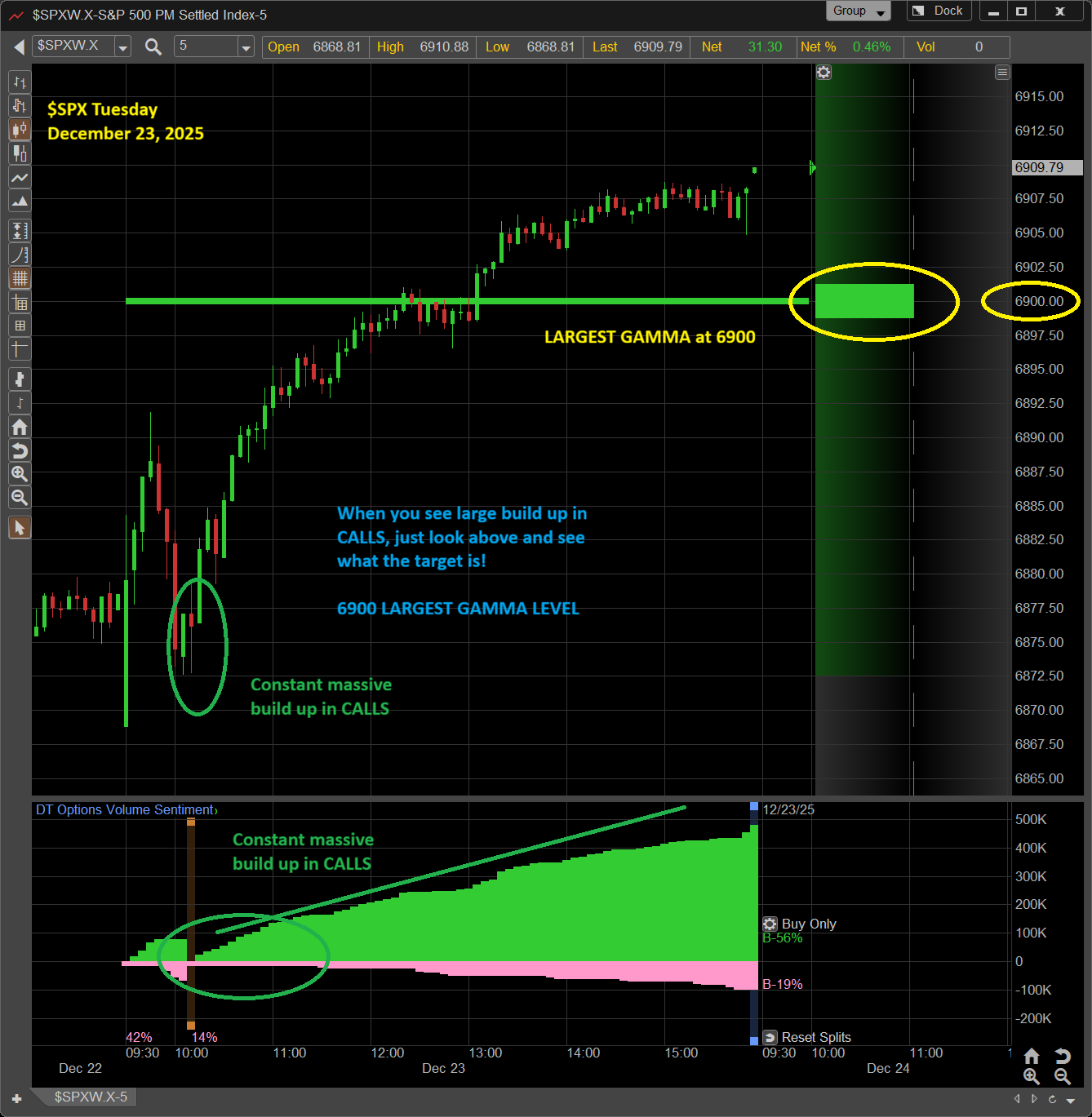

Tuesday December 23rd - $SPX

Dynamic Trend Gamma

Friday December 19th - $SPY

Dynamic Trend Gamma

Thursday December 18th - $SPY

Dynamic Trend Gamma

Wednesday December 17th - $SPY

Dynamic Trend Gamma

Monday December 15th - $SPX

Dynamic Trend Gamma

Friday December 12th - $SPX

Dynamic Trend Gamma

Thursday December 11th - $SPY

Dynamic Trend Gamma

Wednesday December 10th - $SPX

Dynamic Trend Gamma

Monday December 8th - $SPX

Dynamic Trend Gamma

Friday December 5th - $SPX

Dynamic Trend Gamma

Thursday December 4th - $SPX

Dynamic Trend Gamma

Wednesday December 3rd - $SPY

Dynamic Trend Gamma

Monday December 1st - $SPX

Dynamic Trend Gamma

Wednesday November 26th - $SPX

Dynamic Trend Gamma

Tuesday November 25th - $SPY

Dynamic Trend Gamma

Monday November 24th - $SPY

Dynamic Trend Gamma

Friday November 21st - $SPX

Dynamic Trend Gamma

Thursday November 20th - $SPY

Dynamic Trend Gamma

Wednesday November 19th - $SPY

Dynamic Trend Gamma

Monday November 17th - $SPX

Dynamic Trend Gamma

Thursday November 13th - $SPY

Dynamic Trend Gamma

Monday November 10th - $SPX

Dynamic Trend Gamma

Friday November 7th - $SPX

Dynamic Trend Gamma

Thursday November 6th - $SPX

Dynamic Trend Gamma

Wednesday November 5th - $TSLA

Dynamic Trend Gamma

Friday October 31st - $SPY

Dynamic Trend Gamma

Wednesday October 29th - $SPY

Dynamic Trend Gamma

Tuesday October 28th - $SPY

Dynamic Trend Gamma

Monday October 27th - $SPX

Dynamic Trend Gamma

Friday October 24th - $SPX

Dynamic Trend Gamma

Thursday October 23rd - $SPX

Dynamic Trend Gamma

Thursday October 23rd - $TSLA

Dynamic Trend Gamma

Wednesday October 22nd - $SPX

Dynamic Trend Gamma

Monday October 20th - $SPX

Dynamic Trend Gamma

Thursday October 16th - $SPX

Dynamic Trend Gamma

Wednesday October 15th - $SPX

Dynamic Trend Gamma

Tuesday October 14th - $SPX

Dynamic Trend Gamma

Monday October 13th - $SPX

Dynamic Trend Gamma

Thursday October 9th - $SPX

Dynamic Trend Gamma

Wednesday October 8th - $SPX

Dynamic Trend Gamma

Tuesday October 7th - $SPX

Dynamic Trend Gamma

Monday October 6th - $SPX

Dynamic Trend Gamma

Friday October 3rd - $SPX

Dynamic Trend Gamma

Thursday October 2nd - $SPX